These Are The Biggest Regrets Of Famously Successful Investors

They’ve known fame and fortune. But they’ve also known what it feels like to fail. Some of the world’s wealthiest investors are known for having amassed fortunes most of us can only dream of, but in many cases their path to riches has had its share of serious missteps.

Here’s how Suze Orman, Warren Buffet, Dave Ramsey, and Jim Cramer picked themselves up after major financial miscalculations – and picked up a whole lot more wealth after all was said and done.

Suze Orman | Monetary Remorse: Dumping Amazon Stock Too Soon

For Suze Orman, buying Amazon stock back in 1997 was simply a whim: she liked the name. The company started really gaining momentum a few years later, at which time Orman sold her shares. It goes without saying she made a profit on the trade, but only a fraction of what she would make if she traded those Amazon shares today.

Although Orman doesn’t usually encourage buying into individual stocks, she suggests that if you do and it’s a good stock, you should consider holding on to it rather than selling quickly.

Warren Buffett| Monetary Remorse: Buying His Own Company Out Of Spite

In 1962, Warren Buffet invested in Berkshire Hathaway, a failing textile company, when he saw a golden opportunity to make money off of more mills closing. He gobbled up the stock, believing that in the long run the payoff would be substantial. When the manager of Berkshire Hathaway offered to buy the shares back at an extremely low price, an indignant Buffet not only bought more shares but also fired the manager, thereby becoming the owner of a failing business. Buffet believes his spite-driven decision cost him $200 billion over the following 45 years. Ouch.

The upshot: It’s never a good idea, especially when it comes to finances, to choose feelings over facts. Buffet advises investors to choose companies they believe in, focus on strengthening their portfolio, and look ahead to the long term. All while keeping emotions in check.

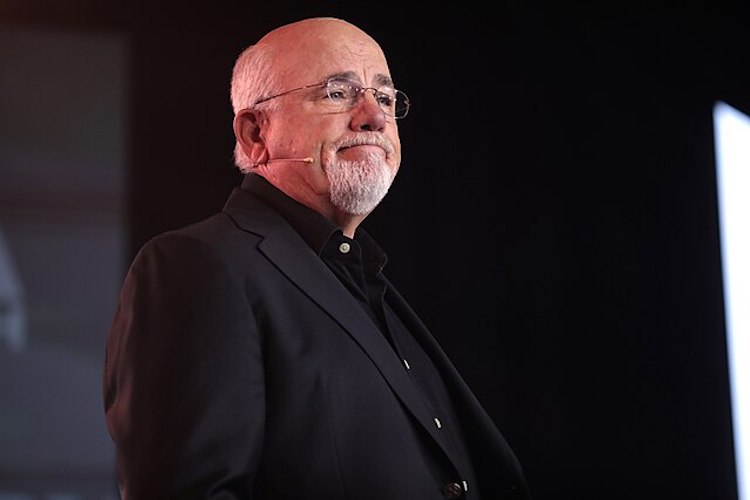

Dave Ramsey | Monetary Remorse: Not Being Deft At Handling Debt

Dave Ramsey was making a mint in his early 20s by flipping houses, but relying on financing to make his deals, and dreams, come true. When his largest lender was sold and the new bank demanded Ramsey pay off his $1 million debt in 90 days, the roof caved in. Although he paid off a significant portion of the debt, he was unable to pay nearly $400,000 and filed for bankruptcy when he was just 28 years old.

Ramsey learned that a financial safety net is a must. After filing for bankruptcy, Ramsey continued to invest in real estate but doesn’t deal in debt. He advises investors to work with a financial advisor, build an emergency fund, save for retirement, and focus on avoiding debt. A lesson learned can bring about money well earned.

Jim Cramer | Monetary Remorse: Selling Stock Even Though He Believed In It

In 2012, Jim Cramer’s charitable trust bought several thousand shares of Bed, Bath, & Beyond stock. Some observers though brick-and-mortar stores like BB&B were on their way out, thanks to online giants like Amazon. But Cramer believed in his decision and held firm, refusing to dump the stock even as it started to dip. When the stock fell below his cost basis, however, he sold it against his better judgment. You could say he took a bath on the deal: The stock eventually rallied and rose well beyond the price at which he sold it.

Cramer advises investors to not be easily swayed from their financial convictions. If you’ve done due diligence and have a strong feeling that you’re right about a particular investment, go with it. Sometimes you need to look beyond what Wall Street thinks to come out ahead.