The 2 Most Effective Ways To Pay Off Debt

Paying off your debt can be a daunting feat, especially when the dollar amount seems insurmountable. But there are simple, effective methods to pay off your debt, as long as you’re committed to the process. The most effective of these are known as the Snowball and Avalanche methods. Each of these requires different steps and has different timelines, so it depends entirely on what works best for you and the amount of debt you need to pay off.

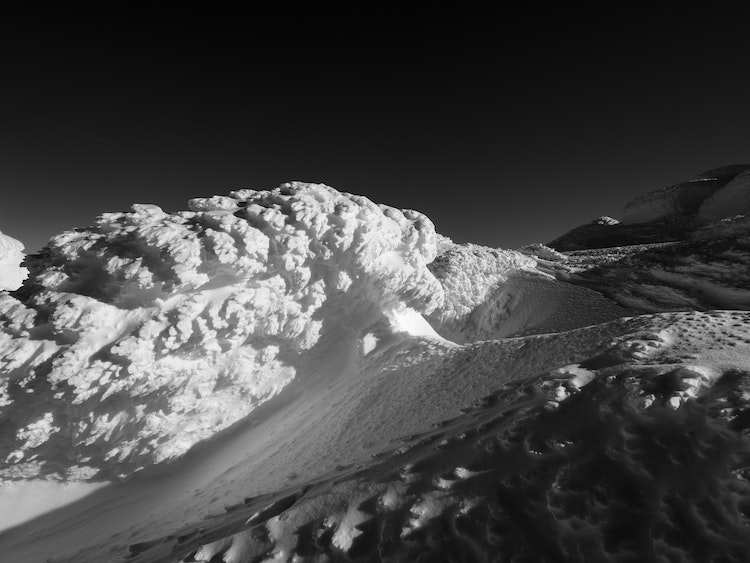

The Snowball Method

If you’re the type who wants faster results or needs regular motivation to reach your goal of paying off your debt, the snowball method may be your best bet. The process is fairly simple. You continue to pay your monthly minimums on all balances, then select your lowest balance. Whenever you have leftover money after paying bills and expenses, you put all of that money toward the lowest balance.

This yields the quickest results and makes it more obvious how quickly your debt will be reduced. This option may be best for those who are new to debt repayment and struggle to keep track of their finances. It’s simple and easy to stay on track with this method. Not to mention, you get the satisfaction of seeing your debt decrease sooner rather than later.

The Avalanche Method

This method requires more patience but will save you money in the long run. That being said, it does require a greater level of discipline. To accomplish paying off your debt using this method, you still need to make sure you’re making all the minimum payments on your balances. The difference is, this time you’ll be putting that extra money towards the debt with the highest interest rate. After the initial balance is paid, you would move on to the balance with the second highest rate, and so on, and so on.

Using this method will help you avoid extra fees and interest that add up over time. The downfall is not seeing significant results nearly as quickly as you would using the snowball method, but overall, more money will be saved. If you have patience and discipline, this method can yield the greatest results.

Summary

Neither method is better than the other. It simply depends on which works best for you. Whether that involves taking a long-term approach with the avalanche method or getting quick results with the snowball method, find what suits your lifestyle and finances.

It’s also important to keep a positive mindset during the process, even if you’re not able to pay off your debt as quickly as you’d like to. It can be challenging to stay focused on your goal when you don’t see results right away but keep at it, and the results will soon reveal themselves.

Whichever method you choose, know that you’re taking steps to secure a healthier financial future and build healthy money habits. Once your debt is paid off, it’s important to keep an eye on your debt to make sure you don’t run into the same situation in the future. Learn from your past and take action to avoid falling into the same situation more than once.