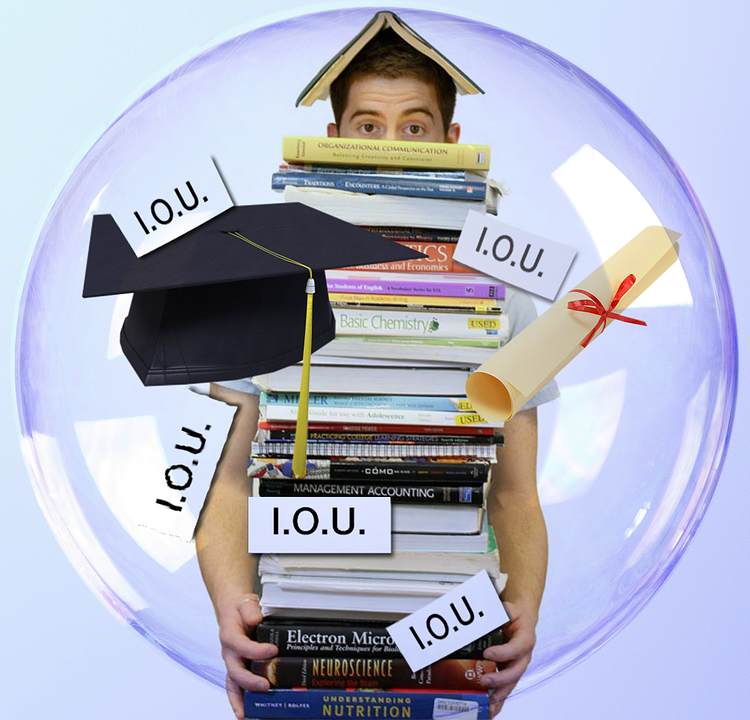

Student Loan Payments Are On The Horizon, Here’s How You Can Take Advantage

February is known for Valentine’s Day, hearts, and flowers, but you might not love the fact that it’s also the month when the reprieve from federal student loan payments might end. Owing to the COVID-19 pandemic, individuals with student loans were allowed to pause their loan payments, along with any interest, for the past several months. But come February, an estimated 40 million borrowers could be required to resume making payments unless another student loan relief package is put into play.

There are, however, a few steps you can take to lessen any student loan panic you might be feeling. By lowering your student loan debt as much as possible, you’ll be in a better position to manage payments and interest rates, even if they return to pre-pandemic levels. You might be surprised at how even small changes can bring you a certain degree of control and calm when it comes to your student loan.

Change Your Payment Plan

If you currently have an income-driven repayment plan, consider switching to a standard repayment plan that could help you become debt-free sooner. With a standard plan, you might find yourself paying a bit more each month, but you’ll be on your way to becoming debt-free sooner.

In addition, enrolling in autopay will qualify you for a quarter-point (0.25) interest rate reduction. A quarter-point sounds like a small amount, but if interest rates return to pre-COVID levels, you could end up saving a noticeable sum in the long run.

Discontinue Your Payments ‘Pause’

Sure, the student loan payment moratorium was more than welcome, but you might want to consider pausing your ‘pause.’ As of this writing, the interest rate on federal student loans is frozen at 0%, which means that any payment you make now will be applied entirely to the loan principal. The more you pay down the principal, the quicker you’ll be able to pay down your debt.

If you’ve taken out a private student loan, the federal pause on payments doesn’t apply. Check with your lender to see if you can take advantage of a forbearance period that will help you better manage your loan obligation during this time of COVID-19 lockdowns and resulting economic difficulties.

Refinance Private Student Loans

If your student loan originates from a private lender, you might be able to reduce your monthly repayment costs by refinancing at a lower rate. Both your credit score and your current income will figure prominently in whether you qualify for a refi. If you’ve lost your job due to the pandemic, don’t lose hope that you’ll be able to get a better rate: Providing proof of income from a side gig or from an investment, or finding a co-signer to back your application, might increase your chances of being eligible for refinancing.

To find the best refinance rates on a private student loan, comparison shop by requesting interest information from more than one financial source. Free services such as Credible can help you compare different quotes from multiple lenders.