Here’s What You Need To Know About Fannie Mae And Freddie Mac

For most, the journey to homeownership starts with a mortgage. Whether you work with a bank or a direct lender, you can be sure they’ll do their best to give you the best deal possible. However, even if your mortgage begins its life with a bank or direct lender, that doesn’t mean it will end there.

More often than not, your lender will sell your mortgage to another servicer. It may be just another bank, but (more than likely) your loan will be sold to one of the two biggest names on the lending scene: Fannie Mae or Freddie Mac. Whether you’re shopping for your first mortgage or already own a home, you could be directly affected by Fannie or Freddie.

What do you really know about these financial behemoths? Knowing who these institutions are and how they operate is essential to making better loan decisions and staying ahead of any surprises. Here is everything you need to know about Fannie Mae and Freddie Mac…

Fannie Mae

After the Great Depression, homeownership was nearly impossible to achieve. The financial collapse had caused many to lose their homes, and banks no longer had the means to lend.

In 1938, Fannie Mae was created to make homeownership a reality once more.

While they don’t directly offer loans, Fannie Mae boosts the mortgage “economy” by purchasing loans from banks and lenders. The lender then has the ability to put that money back into the bank or business to offer more home loans.

Once Fannie Mae purchases your mortgage, it either holds it in their portfolio or bundles it into mortgage-backed securities to sell on the open market.

Freddie Mac

Established by the Emergency Home Finance Act of 1970, Freddie Mac is considered by many to be Fannie’s little brother.

Just like Fannie Mae, Freddie Mac purchases mortgage loans and bundles them together to sell to investors on the open market. Freddie Mac doesn’t directly provide loans. Instead, they purchase mortgages that meet their specific standards.

What’s The Difference?

The primary difference between Fannie Mae and Freddie Mac is that Fannie mostly purchases home loans from commercial banks, whereas Freddie will buy mortgages from smaller banks and direct lenders.

Both have specific guidelines for purchasing loans, including:

- How you are allowed to borrow

- How much your down payment can be

- Minimum and maximum credit scores

Because both set the standards for the loans they’re willing to buy, it’s up to your lender to ensure that your loan meets those standards—especially if the intent is to sell it.

If your loan has been sold to Freddie or Fannie, the only real impact it will have on you is who you make your monthly payments to. Your terms, by law, cannot change.

What Can Fannie And Freddie Do For You?

Both Fannie Mae and Freddie Mac offer programs that enable the average person to buy a home.

Home Ready

HomeReady mortgages from Fannie Mae are designed to be a solution for those who have lower income, but good credit. The HomeReady program features lower down payment requirements—as little as 3%—and lower mortgage insurance premiums. Unlike some low-income loans, HomeReady mortgages allow gifts, funds, and grants to be used for down payments. Credit score requirements are lower as well.

Home Possible

Freddie Mac, of course, has a similar program called Home Possible. Home Possible allows low-to-moderate-income borrowers to qualify with down payments as little as 3%.This program also allows non-occupant co-borrowers—like a relative or friend—to help the primary borrower qualify.

Unlike traditional loans, down payment assistance and even sweat equity are allowable forms of down payment.

What Are The Requirements?

Just like any loan, Fannie and Freddie both have qualification requirements:

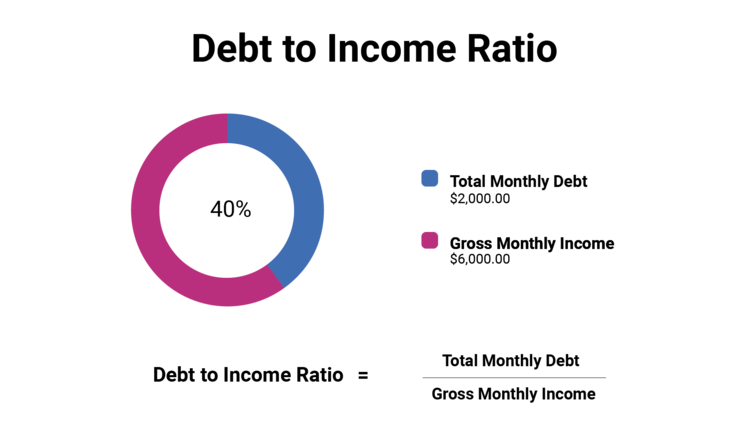

- Debt-to-income (DTI) ratio as high as 43%— even 50%, in some cases

- Credit scores as low as 620

- Down payments as low as 3%

- No major derogatory credit factors (i.e. foreclosures or bankruptcy)

- Three years of verifiable income

- Loan limits for single family homes

Some of these requirements can seem like they’re meant to confuse lendees, but mortgage speak is easier to understand than you’d think. For example, your debt-to-income ratio can be calculated by dividing your total monthly debt by your total monthly income.

Fannie And Freddie: Then And Now

In 2008, there were many experts who pointed a finger at Freddie and Fannie for the housing crisis. Prior to the financial collapse, both organizations had begun to deal in the “subprime” loans that many banks were offering, with little regard for strict borrower qualification standards.

Some subprime loans were even based on negative amortization—this meant many homeowners only paid interest on their loans and the property never built up any real equity. As a result, when the financial crisis hit, most subprime borrowers defaulted on their loans. Fannie Mae and Freddie Mac were bailed out and placed under federal conservatorship.

Today, both Freddie and Fannie have paid back their bailout money in full and, in 2012, became profitable once more. In 2018, Fannie Mae even reported a net profit of $16 billion. The same year, Freddie Mac reported $9.2 billion in net profit. In the coming years, Fannie Mae and Freddie Mac are preparing to exit conservatorship. Both institutions are expected to be released from the program by 2024.

When you’re in the market for a mortgage, knowledge is power. Understanding how companies like Fannie Mae and Freddie Mac function—or simply learning that your loan can and may be sold to another servicer—can have a huge impact on your decisions.

With just a little bit of information, you can go into your next home loan empowered to make the absolute best choices for you.